An Introduction

According to Precedence Research, the quantum computing (QC) industry is a rapidly evolving and expanding field that is expected to experience a compound annual growth rate (CAGR) of 36.9% between now and 2030. That being said, however, according to McKinsey’s estimation, operational quantum computers are only expected to reach about 5,000 by then but, when they do, they will change the world as we currently know it.

By Lorimer Wilson

What Is Quantum Computing?

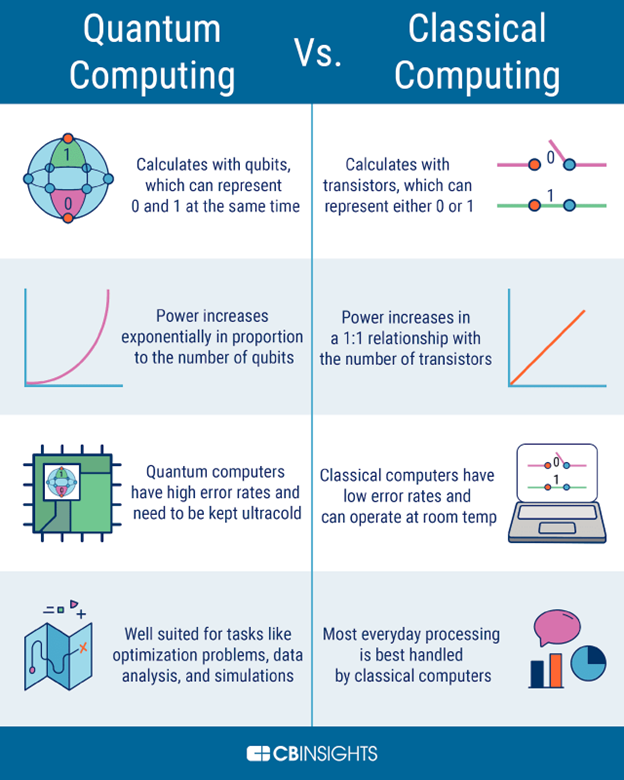

The better the computing power, and the more data, the better a semiconductor will perform and, as such, the race is on for companies to radically upgrade the computing power of their models and that’s where QC comes in. Computers currently operate on a binary system that is equipped with chips that use bits to perform computations but these bits can only show a value of zero or one and, as a result, it takes a lot of zeros and ones arranged in specific orders for a computer to do anything. (Check out this video on Quantum Computing: 4 Things You Need to Know.)

QCs, however, operate with subatomic particles that use quantum bits (qubits) to allow the particles to exist simultaneously in more than one state which increases processing speeds dramatically – and quicker processing speeds mean that computers can tackle more complex problems, which will improve predictive analytics, pattern recognition and complex optimization tasks.

That’s all well and good, but building a QC is extremely expensive, complex and massive, and needs to be kept in stable laboratory conditions, and cooled to nearly absolute zero (-459 degrees Fahrenheit) so, while there are close to 200 companies whose primary focus is on QC Software, according to The Quantum Insider, just over 20 companies worldwide are working on QC Processors and Chips.

Our Pure-Play Quantum Computing Stocks Portfolio

Only 4 small, innovative companies, trading on Canadian and/or American stock exchanges, are exclusively developing and leveraging QC and below is how each performed in August, in descending order, and YTD, along with their business profile, market capitalization and any news, analyses and commentary related to those changes:

- D-Wave Quantum (QBTS): UP 1.0% in August; UP 14.8% YTD

- Company Focus: focuses on quantum annealing technology

- Market Capitalization: $203M

- Latest News, Analyses and/or Commentary:

- Quantum Computing (QUBT): DOWN 4.4% in August; DOWN 28.6% YTD

- Company Focus: developing photonic qubits that offer a number of key advantages over trapped ions or superconducting qubits

- Market Capitalization: $61M

- Latest News, Analyses and/or Commentary:

- IonQ (IONQ): DOWN 9.0% in August; DOWN 40.1% YTD

- Company Focus: planning to build a network of quantum computers accessible via the cloud using trapped-ion technology in its processing units which relies on suspending ions in space using electromagnetic fields, and transmitting information through the movement of those ions in a “shared trap.”

- Market Capitalization: $1,590M

- Latest News, Analyses and/or Commentary:

- Rigetti Computing (RGTI): DOWN 10.7% in August; DOWN 6.1% YTD

- Company Focus: specializes in superconducting qubit technology and has developed a suite of software tools and algorithms for programming and simulating quantum computations

- Market Capitalization: $175M

- Latest News, Analyses and/or Commentary:

Summary

The Pure-Play Quantum Computing Stocks Portfolio was DOWN 7.9% in August and is now DOWN 34.1% YTD.

Thank you for reading the above article. I will update it weekly. Now, as a reward, here is a link to Money, Money, Money—It’s a Rich Man’s World!