An Introduction

“The inflating bubbles around the world encompass a wide range of sectors, including the U.S. stock market, housing, tech startups, much of the cryptocurrency space, healthcare, higher education, and auto loans. Beyond the U.S., bubbles are also evident in housing markets across Canada, Australia, and Western Europe, government debt, as well as in China’s economy. Collectively, I refer to these interconnected bubbles as “The Everything Bubble.” This overarching phenomenon is the result of a massive and reckless monetary experiment undertaken by central banks since 2008.”

Jesse Colombo goes on to say in edited and abridged excerpts from his latest newsletter.

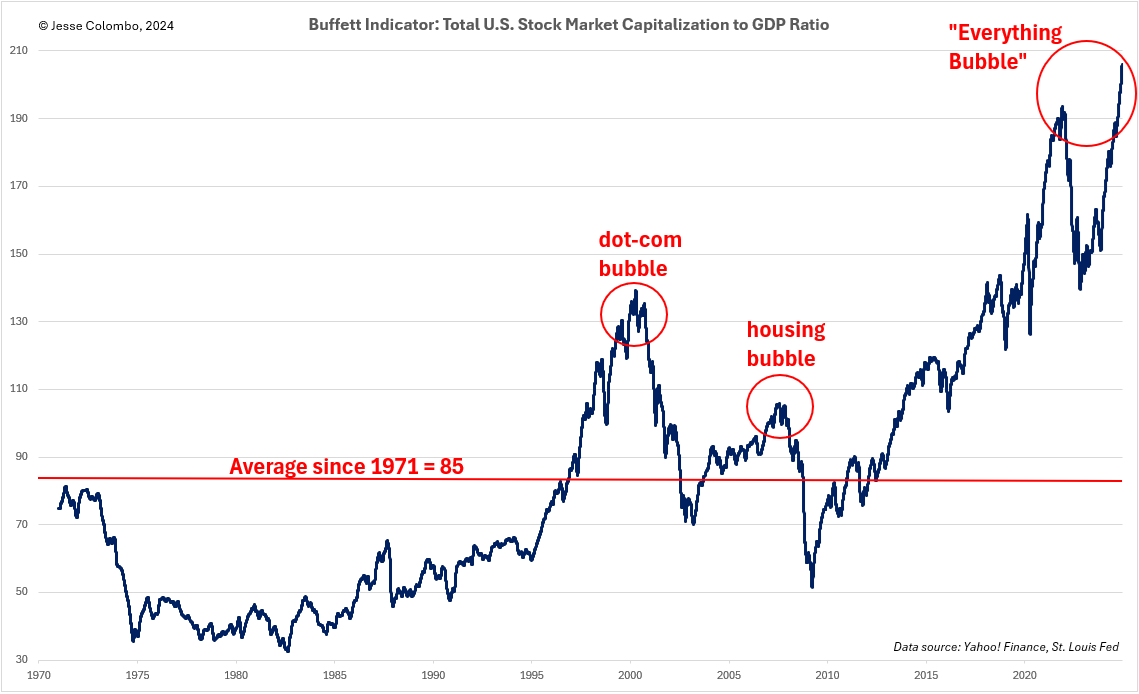

The Buffett indicator

For example, let’s take a look at the U.S. stock market bubble. A highly revealing measure of whether the stock market is in bubble territory is the total U.S. stock market capitalization-to-GDP ratio, which compares the market’s total value to the underlying economy. This metric is often referred to as the “Buffett Indicator,” as Warren Buffett has famously called it “the best single measure of where valuations stand at any given moment.”

When the stock market grows faster than the economy, the stock market capitalization-to-GDP ratio rises—leaving the market vulnerable to a correction. Currently, this indicator stands at a staggering 206, which is 142% above its long-term average of 85, dating back to 1971. This is clear and undeniable evidence that the U.S. stock market is drastically overvalued—surpassing even the excesses of the late-1990s dot-com bubble, which ended in disaster. History shows that valuations inevitably revert to the mean over time, putting the market at serious risk of a sharp and violent downturn.

I strongly believe that the inevitable bursting of the massive U.S. stock market bubble is going to prove highly beneficial for both gold and silver as capital will flow out of overvalued stocks into safe-haven assets that have stood the test of time over thousands of years.

In addition, the U.S. government and the Federal Reserve will take extraordinary measures to prop up the collapsing bubble but will ultimately fail. These desperate measures will include:

- massive increases in government debt,

- slashing interest rates back to zero (and ultimately into negative territory),

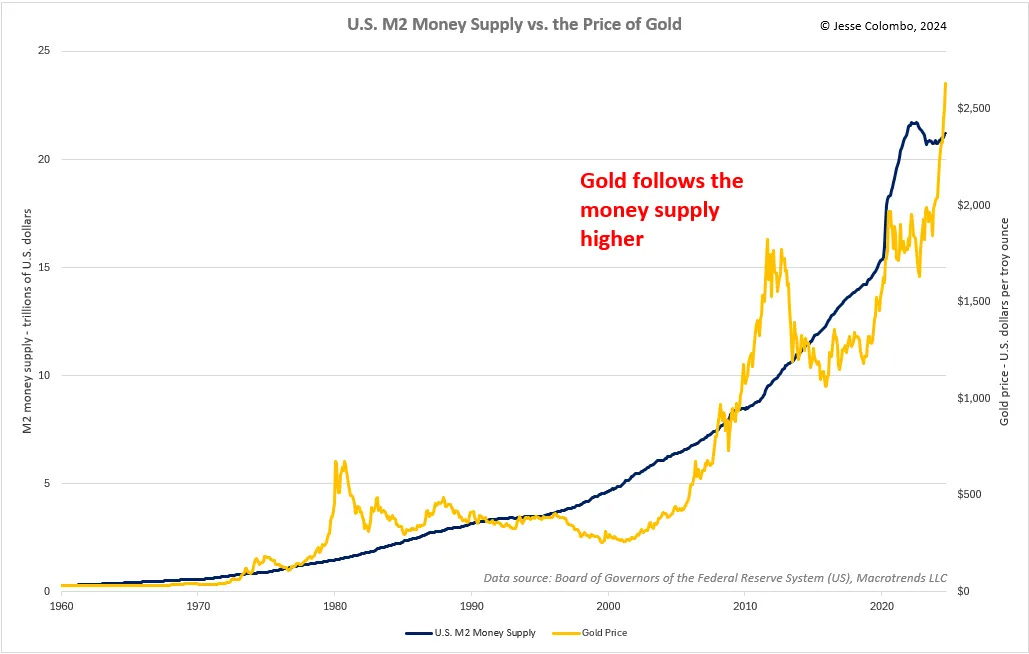

- and injecting trillions of new dollars into the economy through quantitative easing (QE). QE significantly increases the money supply, a key driver of gold prices, as illustrated in the chart below.

Highly Bullish Environment For Precious Metals

Each of the above actions will create a highly bullish environment for precious metals, solidifying their status as the ultimate safe-haven asset during times of economic uncertainty and turmoil.

Conclusion

Humanity has never been in a more precarious position economically or socially.

- The bursting of ‘The Everything Bubble’ won’t result in a mere garden-variety recession; instead, it will fundamentally dismantle the global economy, hollowing it out and bringing an end to the current economic paradigm that has sustained our high standard of living.

- There’s no viable alternative to replace our current debt and asset bubble-driven economic model, making the coming reckoning all the more severe.

- Even more alarming is how few people are aware of these looming risks.

Like our new site? Here are 10 ways to get involved:

- Listen to the MunAiMarkets theme song and join the rich man’s world!

- Follow MunAiMarkets on Facebook and never miss an article.

- Share this article on LinkedIn, X and/or Pinterest.

- Watch our latest video posts on youtube.

- Comment on our articles and ask any questions you have.

- Submit an article for posting consideration.

- Become the site’s primary contributor and a full partner.

- Advertise on the MunAiMarkets side panel for a token $10/mo. in 2025.

- Sponsor one of the site categories or an individual article for a modest fee.

- Support our efforts with a financial contribution.