According to Fortune Business Insights, the global cloud computing (CC) SaaS market is projected to have a CAGR of 18.4% between now and 2032 which should bode well for CC companies and, if the Q1 results of ServiceNow, for example, are any indication the sector is well on its way to reaching those numbers.

What is Cloud Computing?

Cloud computing (CC) is the technique of processing, storing, and managing data on a network of remote computers hosted on the internet by cloud service providers rather than on a personal computer or local server using only as much compute power and storage as needed to meet demand. This theoretically allows for cheaper and faster computing because it eliminates the need to purchase, install, and maintain servers.

What is SaaS?

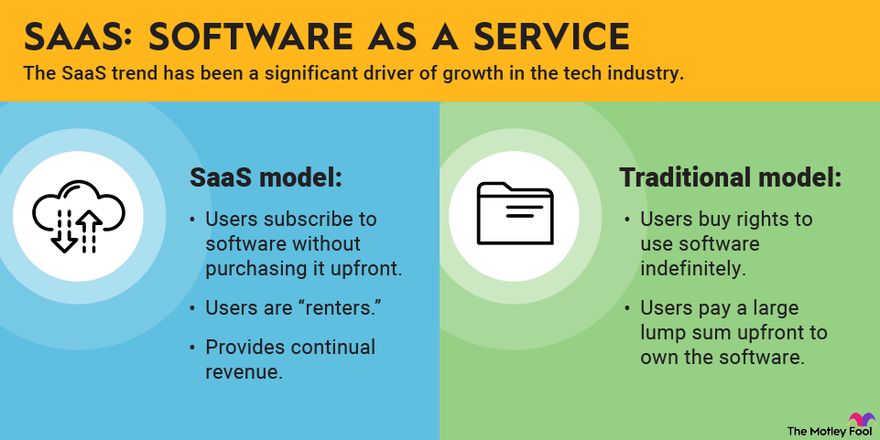

SaaS, also known as cloud application services, makes software available to users over the internet, usually for a monthly subscription fee. They are typically ready-to-use and are run from a users’ web browser which allow businesses to skip any additional downloads or application installations. SaaS accounts for 38.5% of cloud computing revenue. (Source) For more insightful information you are encouraged to read Cloud Computing 101.

Image source: The Motley Fool

What’s the current state of the SaaS industry?

SaaS transformed the global enterprise software market growing at double the rate of the overall market between between 2100 and 2018 but it has slowed since then with the reduction in IT spending as interest rose leading to cash flow issues and the recent unprecedented growth of gen AI has disrupted the software industry even faster and more thoroughly than SaaS.

What Impact Will Gen AI Have On the Software Space and, By Extension, the SaaS Market?

Gen AI allows software leaders to reexamine and address customer needs in a totally new way, as well as to explore adjacencies they hadn’t thought of before and McKinsey research indicates that gen AI will trigger software customers to switch their vendors more frequently – by 5-10 percentage points -as they race to keep up with the latest innovations. As such, SaaS companies will do well to prepare for this shift by:

- working to both keep up with software application development;

- protecting existing client relationships by reexamining and addressing customer needs in a totally new way;

- exploring adjacencies they hadn’t thought of before;

- considering how they price and package their products;

- evaluating how they gather and use their proprietary data; and

- revamping product strategy and their road map for the gen AI era.

How can new SaaS business building help organizations drive growth?

Growth is a constant goal—and challenge—for most companies. We’ve found that many companies expect to get as much as 50 percent of their revenue from new businesses and products by 2026. SaaS can help by allowing companies access to all the software services they need without having to create the software themselves but most organizations are not on a path that will get them there. In fact, only 6% of global software revenues are earned by non-tech companies.

The MunAiMarkets Pure-Play Cloud Computing SaaS Stocks Portfolio

Below is a list of the 7 largest pure-play cloud SaaS software computing companies presented in descending order of their performances week-ending April 25th and MTD:

- ServiceNow (NOW): UP 22.4% w/e April 25th; UP 18.5% MTD

- ServiceNow’s stronger-than-expected Q1 earnings and guidance reassured investors that the sector might offer a rare bright spot in an economy clouded by rising tariffs and recession fears, and generating its biggest one-day gain in over a decade, making the company the top performer in the S&P 500.

- HubSpot (HUBS): UP 14.0% w/e April 25th; UP 5.7% MTD

- Atlassian (TEAM): UP 12.8% w/e April 25th; UP 4.9% MTD

- Cloudflare (NET): UP 12.1% w/e April 25th; UP 5.3% MTD

- Datadog (DDOG): UP 11.3% w/e April 25th; UP 0.4% MTD

- MongoDB (MDB): UP 8.9% w/e April 25th; DOWN 2.5% MTD

- Workday (WDAY): UP 8.4% w/e April 25th; UP 0.5% MTD

Please note: for

- a chart of the historical Portfolio YTD, 1M, 6M and 1Y Performances, go HERE, Add Specific Portfolio Symbols, Scroll Down to Portfolio Performance Settings & Click on Calculate Performance, Scroll Down to Portfolio Performance Chart & Specify Time Period and Scroll Down to Returns by Period.

- a specific stock price performance (currently, yesterday, over the past 5 days, 1 month, 6 months and 1 year) go HERE, type in the Stock Symbol, and Click on Time Period

- a specific stock’s performance statistics and financials go HERE, type in Stock Symbol, and Click on Statistics and Financials

- the reasons behind the price change in a specific stock go HERE and ask “Why did x stock change price so much this week?”

- the latest articles and analyses go HERE, type in Stock Symbol, and Scroll down to Recent News

Summary

The above 7 pure-play cloud SaaS computing stocks model portfolio was UP 15.8% w/e April 25th and is now UP 8.7% MTD

Conclusion

As mentioned in the introduction, the global cloud computing SaaS market is projected to have a CAGR of 18.4% between now and 2032 which should bode well for CC companies as the stock price performance of ServiceNow can attest.

Like our new site? Here are 8 ways to get involved:

- Listen to the MunAiMarkets theme song and join the rich man’s world!

- Follow MunAiMarkets on Facebook and never miss an article.

- Share this article on LinkedIn, X and/or Pinterest.

- Watch our MunAiMarkets video posts on youtube.

- Comment on the MunAiMarkets articles and ask any questions you have.

- Advertise on the MunAiMarkets banner for a token $10/mo. in 2025.

- Sponsor one of the MunAiMarkets categories or an individual article for a modest fee.

- Support our efforts with a modest financial contribution.