An Introduction

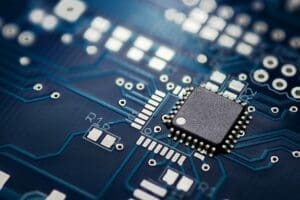

The semiconductor industry plays a crucial role in driving technological advancements and innovations and is also a key enabler for the growth of other industries, such as automotive and healthcare, therefore, understanding the semiconductor value chain and the companies involved in it is crucial for anyone interested in technology and its impact on the global economy and that is what this article does. Read on.

What Is the Semiconductor Value Chain?

The semiconductor value chain refers to the various stages involved in the production and distribution of semiconductor devices such as microprocessors, memory chips, and sensors which are used in a wide range of electronic devices, including smartphones, computers, and automobiles. The semiconductor value chain is a complex and dynamic process that involves multiple companies, each with their own specialized roles. (Source)

There are the 5 segments in the semiconductor value chain of which pure-play fabless semiconductor companies are one and the performances of the 6 companies in that segment are tracked and commented on by MunAiMarkets below.

What Is A Pure-Play Fabless Semiconductor Company?

A pure-play company is one that concentrates its efforts on one single line of business and a fabless (fabrication-less) manufacturer designs and sells hardware devices and semiconductor chips while outsourcing their fabrication (or fab) to a specialized manufacturer.

The MunAiMarkets Pure-Play Fabless Semiconductor Companies Portfolio

There are only 6 pure-play fabless semiconductor companies trading on U.S. stock exchanges and they are outlined below as to their stock performances so far in May (i.e. May 23rd), in descending order, and YTD, along with any recent news, analyses and/or commentary on them where available:

- Nvidia (NVDA): UP 20.5% MTD; DOWN 2.2% YTD;

- Broadcom (AVGO): UP 18.8% MTD; DOWN 1.4% YTD;

- Advanced Micro (AMD): UP 3.3% MTD; DOWN 8.4% YTD;

- Monolithic Power (MPWR): UP 11.6% MTD; UP 13.8% YTD;

- Marvell (MRVL): UP 4.0% MTD; DOWN 45.1% YTD;

- Qualcomm (QCOM): DOWN 2.1% MTD; DOWN 5.4% YTD

Summary

The MunAiMarkets Pure-Play Fabless Semiconductor Companies Portfolio is UP 11.7% so far in May (May 23rd) but remains DOWN 0.3% YTD.

Please note: For

- a chart of the historical Portfolio YTD, 1M, 6M and 1Y Performances, go HERE, Add Specific Portfolio Symbols, Scroll Down to Portfolio Performance Settings & Click on Calculate Performance, Scroll Down to Portfolio Performance Chart & Specify Time Period and Scroll Down to Returns by Period.

- a specific stock price performance (currently, yesterday, over the past 5 days, 1 month, 6 months and 1 year) go HERE, type in the Stock Symbol, and Click on Time Period

- a specific stock’s performance statistics and financials go HERE, type in Stock Symbol, and Click on Statistics and Financials

- the reasons behind the price change in a specific stock go HERE and ask “Why did x stock change price so much this week?”