Introduction

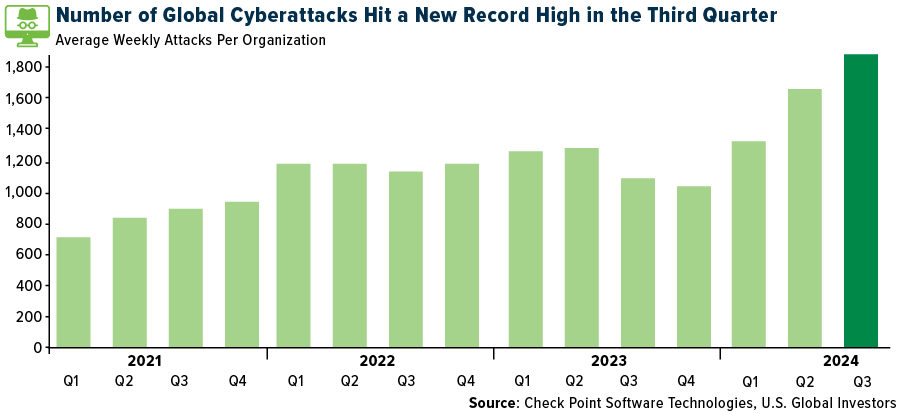

Cyberattacks have skyrocketed in the past year, with the average number of weekly attacks climbing 75% globally year-over-year (56% in the U.S.), to hit a record high of 1,876 per organization (1,300 in the U.S.) weekly. As such, businesses, governments and individuals are racing to protect themselves from these threats and, as such, the need for robust cybersecurity will only increase. (Before proceeding listen to the MunAiMarkets theme song and get in the mood to join the rich man’s world!)

Research forecasts that corporate spending on cybersecurity should grow at a CAGR of 13.8% between now and 2030 (source) and, for investors, this means that companies developing cutting-edge technology to secure networks and data could be positioned for explosive growth and be excellent long-term buys.

What Are Cyber Security Software Companies?

Cyber security companies train their models with data from previous attacks to create autonomous systems that can detect if an attack is ongoing based on certain readings. As a result that increases companies’ lead time for an attack and allows them to prepare mitigation and response strategies. Video: How AI is changing the cybersecurity landscape.

The Addressable Market Is Huge

It is estimated that cyber security spending was only approximately $200B in 2024 but, with only an estimated 10% penetration of security solutions today, the total opportunity amounts to a staggering $1.5 trillion to $2 trillion at the current growth rate of 12.4% annually off a base of approximately $150 billion in 2021 which is a significant uptick from the 10% growth over the past 3-5 years, and this is forecast to grow at a CAGR of 13.8% between now and 2030 (source).

Summary

As outlined above, businesses, governments and individuals are racing to protect themselves from cyber threats, and this need for robust cybersecurity will only increase. For investors, This means that companies developing cutting-edge technology to secure networks and data could be positioned for explosive growth.

MunAiMarkets CyberSecurity Software Stocks Portfolio

eSecutityPlanet.com provides a list of cyber security companies (see here) of which the 5 largest of those companies (i.e. +$20B market capitalization) are highlighted below in the MunAiMarkets Pure-Play CyberSecurity Software Stocks Portfolio conveying how the constituents have performed MTD, in descending order, and in 2024 which should assists you in any due diligence of the sector.

- CrowdStrike Holdings (CRWD): UP 4.3% MTD; UP 34.0% in 2024

- Reason for Price Change:

- Strong Earnings Report: CrowdStrike reported impressive earnings, surpassing expectations and boosting investor confidence.

- Positive Analyst Ratings: Analysts have maintained a favorable outlook on CrowdStrike, with the company holding a Zacks Rank of #2 (Buy).

- Market Position: CrowdStrike’s strong market position and growing demand for its cybersecurity solutions have contributed to its stock’s upward momentum.

- Reason for Price Change:

- Zscaler (ZS): UP 4.0% MTD; DOWN 18.6% in 2024

- Reason for Price Change:

- Strong Earnings Report: Zscaler reported first-quarter fiscal 2025 non-GAAP earnings of 77 cents per share, surpassing the Zacks Consensus Estimate by 22.2% and revenues also exceeded expectations, coming in at $628 million, a 26.4% year-over-year increase.

- Positive Analyst Ratings: Analysts have maintained a favorable outlook on Zscaler and this positive sentiment has contributed to the stock’s upward momentum.

- Market Position: Zscaler’s strong market position and growing demand for its cloud-native cybersecurity solutions have bolstered investor confidence.

- Reason for Price Change:

- Check Point Software Technologies (CHKP): UP 0.6% MTD; UP 22.2% in 2024

- Reason for Price Change:

- Analyst Downgrades: Goldman Sachs downgraded Check Point Software from a “Strong Buy” to a “Hold” and raised their price target slightly.

- Market Sentiment: There has been a general negative sentiment towards high-growth tech stocks, which has impacted Check Point Software.

- Leadership Transition: The company recently announced a leadership transition, with Nadav Zafrir taking over as CEO from Gil Shwed, who had been CEO for 30 years. Such transitions can sometimes create uncertainty among investors.

- Reason for Price Change:

- Fortinet (FTNT): UP 0.5% MTD; UP 61.4% in 2024

- Reason for Price Change:

- Market Sentiment: There has been a general negative sentiment towards high-growth tech stocks, which has impacted Fortinet.

- Valuation Concerns: Fortinet’s stock is trading at a premium compared to its industry peers, with a forward price-to-earnings (P/E) ratio of 39.95, higher than the industry average of 28.07.

- Analyst Ratings: While Fortinet holds a “Hold” rating from most analysts, there have been some downgrades and concerns about its growth prospects.

- Reason for Price Change:

- Palo Alto Networks (PANW): DOWN 2.7% MTD; UP 34.0% in 2024

- Reason for Price Change::

- Valuation Concerns: Palo Alto Networks is trading at a premium compared to its industry peers, with a forward price-to-earnings (P/E) ratio of 54.7, significantly above the industry average of 27.61.

- Slowing Revenue Growth: The company’s revenue growth has decelerated, with a 16% year-over-year growth in fiscal 2024, compared to 25% growth in fiscal 2023.

- Analyst Ratings: Several analysts have downgraded their ratings for Palo Alto Networks, citing concerns about its near-term growth prospects.

- Reason for Price Change::

Go HERE for a live chart (updated minute-by-minute) of each constituent in the portfolio (Not yet available).

Summary

On average, the above 5 pure-play cybersecurity software stocks are UP 1.9% MTD and were UP 22.4% in 2024.