Introduction

For the last 15 years, all you’ve needed to do to achieve double-digit returns on your money was park it in an S&P 500 index fund, reinvest dividends, and forget about it. That happy ride may be over, according to a new note from Goldman Sachs that points out that the S&P is on track to return only about 3% a year in the coming decade, compared to 13% average annual returns over the last ten years. That being said, Citi points out that, while “down drafts are likely from the current valuation levels it isn’t only the Magnificent Seven that’s winding up potential energy for one massive implosion but the entire U.S. stock market” and that, because much of the money being stored in the S&P 500 is coming from all over the world, the correction will be global.

Listen to the MunAiMarkets theme song and join the rich man’s world!

Market Valuations

Many stock analysts are worried about the stretched valuations of the S&P 500 but, while the forward P/E ratio of the stocks in the S&P 500 is very concentrated in a handful of tech stocks, it isn’t the “Magnificent 7” companies – Amazon, Apple, Google, Meta, Microsoft, Nvidia and Tesla – that are mostly trading at valuations they haven’t seen before, but the rest of the market that’s in uncharted territory.

The Magnificent 7 are collectively trading at a forward P/E of 30.8, but that’s only about the 90th percentile of where they’ve traded since 2004 and they were more richly valued, for instance, for most of 2020 and 2021. It’s the forward P/E ratio of the 493 stocks in the S&P 500 that aren’t the Magnificent 7 that stands at 19.8, according to Citigroup. That’s unprecedented over the past 20 years.

Follow MunAiMarkets on Facebook and never miss an article.

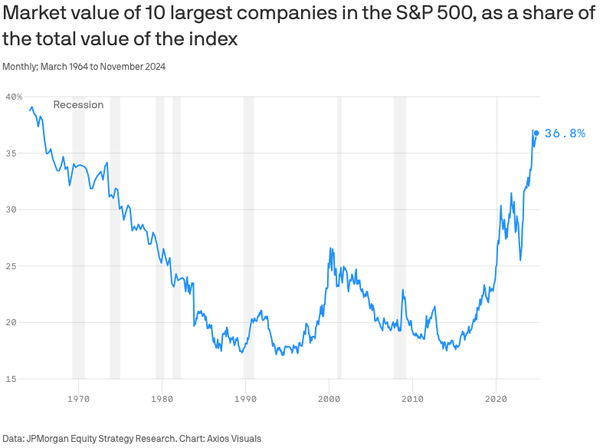

Market Concentration

The stock market hasn’t looked this top-heavy since 1965 with the market value of the top 10 companies in the S&P 500 making up nearly 37% of the index’s total value and some on Wall Street have fretted over this market concentration with JPMorgan referring to it as “increasingly unhealthy” and, in a recent recent note, Goldman’s chief U.S. equity strategist David Kostin and his team wrote that episodes of highly concentrated markets don’t last and there are risks to the stock market heading into 2025.

|

Comment on this article and ask any questions you have.

Mega-cap Performance

Goldman Sachs reports that the Magnificent Seven’s stock market dominance may be waning. It accounted for more than half of the 57% rise in the S&P 500 over the past two years but the year-over-year outperformance gap has recently narrowed:

- In 2023, the seven stocks generated a 76.3% return, against a 13.8% return for the others, about a 63 percentage point difference.

- In 2024, so far, that “premium return” gap is 22 percentage points.

- In its 2025 U.S. equity outlook, Goldman expects that premium gap could be as small as 7 percentage points as earnings growth cools.

- Citi still sees the S&P gaining ground in 2025 but believes the downside is bigger than the upside. Their “bull case” is 6,900, up 14%, while their “bear case” is 5,100, down 16%.

Goldman Sachs concludes that, while the mega-cap seven have played a huge role in the S&P 500’s fabulous run over the past two years they are, in Goldman’s estimation, trading around fair value, meaning they will need to keep growing at outsized rates for shares to keep climbing.

Wild Card

Perhaps the biggest wild card is the incoming presidential administration:

- Will Donald Trump’s plans to cut corporate taxes and reduce regulations fuel growth?

- Will mass deportations and tariffs fuel inflation, leading to interest rate hikes?

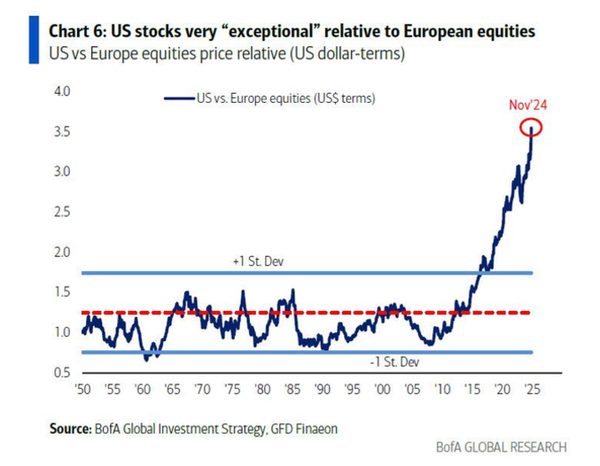

Global Implications

Much of the money that is being stored in the S&P 500 is coming from all over the world and, as such, any correction will be global.

|

Like our new site? Here are 10 ways to get involved:

- Listen to the MunAiMarkets theme song and join the rich man’s world!

- Follow MunAiMarkets on Facebook and never miss an article.

- Share this article on LinkedIn, X and/or Pinterest.

- Watch our latest video posts on youtube.

- Comment on our articles and ask any questions you have.

- Submit an article for posting consideration.

- Become the site’s primary contributor and a full partner.

- Advertise on the MunAiMarkets side panel for a token $10/mo. in 2025.

- Sponsor one of the site categories or an individual article for a modest fee.

- Support our efforts with a financial contribution.