An Introduction

The pharmaceutical industry is embracing AI to streamline drug discovery and development because creating a new drug using AI can help a company, in some cases, develop a new drug in a matter of days instead of the years it might take using the traditional clinical trial approach.

- According to Grand View Research the global “AI in drug discovery” market was worth about $1.1 billion last year but should grow at a 30% clip from 2023 to 2030;

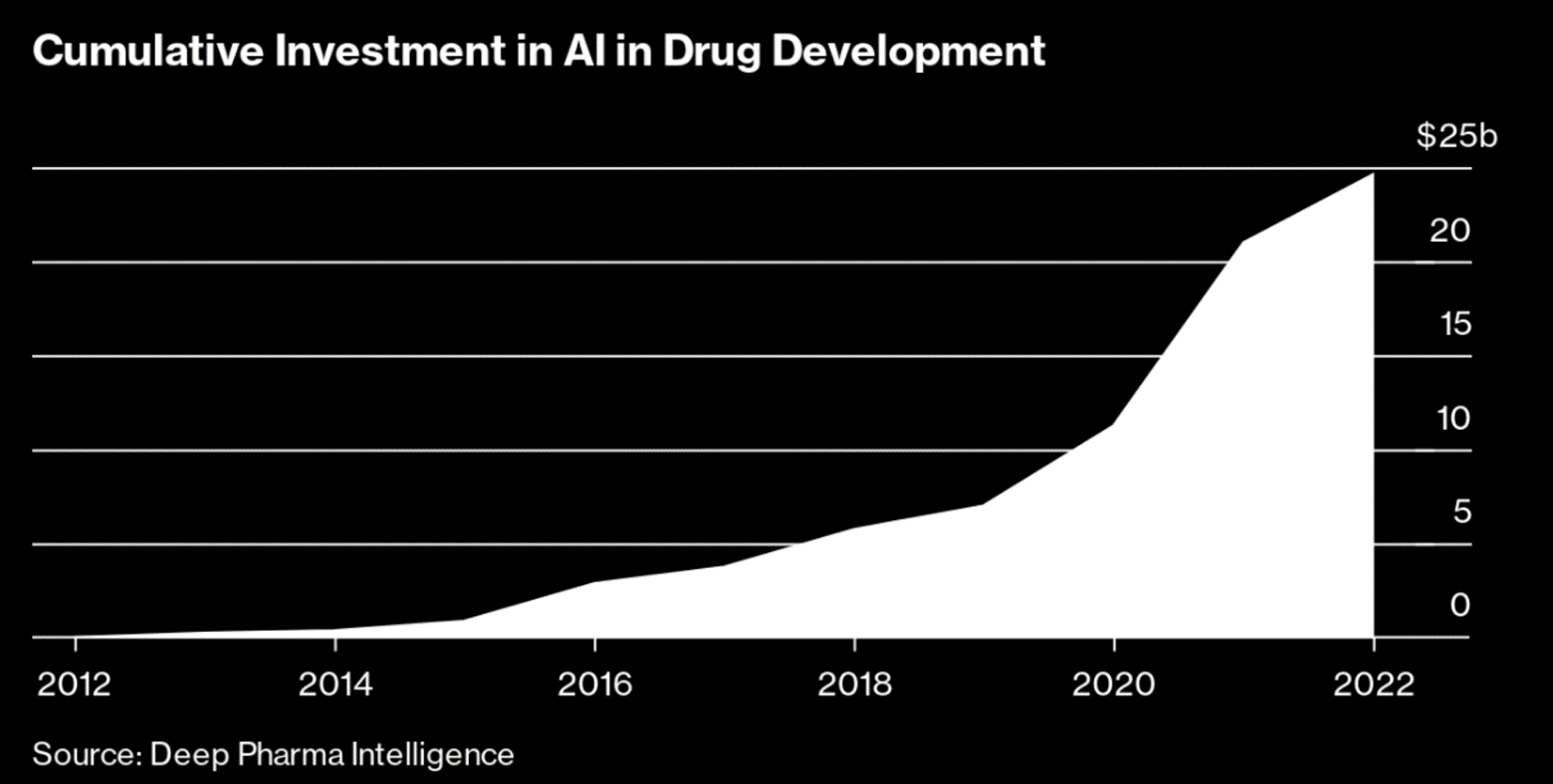

- Deep Pharma Intelligence estimates that investments in the field of AI-powered drug discovery have tripled over the past four years to nearly $25 billion;

- Janssen Research & Development (JNJ arm) concludes the AI method to be up to 250 times more efficient than the traditional method of drug discovery holding the potential to reduce timelines for drug discovery, to increase accuracy of predictions on efficacy and safety as well as to create better, and more, opportunities to diversify drug pipelines; and

- Morgan Stanley believes that AI-powered drug discovery will lead to an additional 50 novel therapies being brought to market over the next decade, with annual sales in excess of $50 billion! In other words, a $50 billion AI drug discovery revolution is underway.

Source: Deep Pharma Intelligence

The Clinical Trial Process

New drugs are currently approved through human clinical trials: rigorous, year-long procedures starting in animal trials and gradually moving to patients in trials who are exposed to side effects that cannot be predicted or expected. The process typically cost billions of dollars and take many years to complete, sometimes more than a decade, and, even if their trials are successful, they still have to receive approval of a country’s respective regulatory agency. Source

Source: Biosourcing

Why Use AI Technology In Drug Development?

AI technology, however, helps companies aggregate and synthesize a lot of information that’s needed for clinical trials, thus shortening the drug development process. It can also help understand the mechanisms of the disease, establish biomarkers, generate data, models, or novel drug candidates, design or redesign drugs, run preclinical experiments, design and run clinical trials, and even analyze the real-world experience. Source

The MunAiMarkets AI-focused Drug Discovery Stocks Portfolio

The following 5 clinical-stage companies are using AI to facilitate their discovery and development of new drugs and trade on various Canadian and American stock exchanges. They are listed below in descending order of their stock performances MTD (as of January 21st) and in 2024 along with a description of their areas of focus, their market capitalizations, their product pipeline, and reasons for their price changes.

Go HERE for a live chart (updated minute-by-minute) of each constituent in the portfolio (Not available yet)

- Absci Corporation (ABSI): UP 22.9% MTD; DOWN 37.6% in 2024

- Area of Focus: analyzes drug characteristics that may provide therapeutic benefit. (see details here)

- Market Capitalization: $370M

- Pipeline: (see here)

- Reasons Behind Price Change:

- Strategic Partnership: ABSI Corporation has announcement a strategic partnership with M13, a venture capital firm known for disruptive innovation. This partnership is expected to bring substantial growth opportunities for ABSI.

- Advancements in its AI Drug Creation platform: ABSI has unveiled advancements in its AI Drug Creation platform, highlighting potential phase 1 trials for drugs ABS-201 and ABS-101, as well as refining an antibody lead for ABS-301. These developments have generated a lot of excitement and optimism among investors.

- Increase in Investor Confidence: ABSI’s financial performance and strategic investments have boosted investor confidence. Despite reporting a net loss, ABSI’s strong cash reserves and high total asset valuation have provided a solid financial backbone.

- Relay Therapeutics (RLAY): UP 13.1% MTD; DOWN 62.6% in 2024

- Area of Focus: uses its platform to enhance small molecule therapeutic discovery in targeted oncology and genetic disease indications (see details here)

- Market Capitalization: $780M

- Pipeline: (see here)

- Reasons Behind Price Change:

- Positive Analyst Ratings: Analysts have given RLAY a “Moderate Buy” rating, with price targets suggesting a potential increase. This has boosted investor confidence.

- Strategic Collaborations: RLAY continues to strengthen its partnerships with major pharmaceutical companies, which has attracted investor interest.

- Institutional Investments: There have been notable inflows from hedge funds and institutional investors, further boosting confidence in the stock.

- Innovative Technology: RLAY’s cutting-edge AI-driven drug discovery platform continues to attract investor interest.

- Schrödinger (SDGR): UP 10.6% MTD; DOWN 46.1% in 2024

- Area of Focus: uses its platform to discover novel molecules which it leverages to build a pipeline of its own clinical programs in addition to selling access to its platform to other pharmaceutical firms (see details here)

- Market Capitalization: $1,380M

- Pipeline: (see here)

- Reasons Behind Price Change

- Unusually High Options Trading: There has been a surge in call options trading, with a significant increase in the number of call options being bought. This indicates strong bullish sentiment among investors.

- Institutional Investments: Large investors, including hedge funds, have increased their stakes in Schrodinger, boosting confidence in the stock.

- Positive Analyst Ratings: Analysts have given SDGR a “Moderate Buy” rating, with price targets suggesting a potential increase.

- AbCellera Biologics (ABCL); UP 4.8% MTD; DOWN 48.7% in 2024

- Area of Focus: searches for antibodies from natural immune responses which are then outsourced to their partners. (see details here)

- Market Capitalization: $877M

- Pipeline: (see here)

- Reasons Behind Price Change:

- Positive Analyst Ratings: Analysts have given ABCL a “Buy” rating, with price targets suggesting a potential increase of up to 329.59% over the next twelve months.

- Strategic Collaborations: AbCellera continues to strengthen its partnerships with major pharmaceutical companies like Eli Lilly and Moderna, which boosts investor confidence.

- Financial Stability: Despite reporting a net loss, ABCL maintains a solid financial foundation with $700 million in cash and short-term investments.

- Innovative Technology: AbCellera’s cutting-edge AI-driven antibody discovery platform continues to attract investor interest.

- Recursion Pharmaceuticals (RXRX): UP 1.8% MTD; DOWN 31.4% in 2024

- Area of Focus: decodes biology by integrating technological innovations to industrialize drug discovery (see details here)

- Market Capitalization: $2,560M

- Pipeline: (see here)

- Reasons Behind Price Change:

- High Options Trading: RXRX has been the target of unusually high options trading, with a significant increase in call options being bought. This indicates strong bullish sentiment among investors.

- Institutional Investments: There have been notable inflows from hedge funds and institutional investors, boosting confidence in the stock.

- Positive Analyst Ratings: Analysts have given RXRX a “Buy” rating, with price targets suggesting a potential increase of up to 71.34% over the next twelve months.

Summary

The MunAiMarkets Ai-focused pure-play drug discovery stocks portfolio is UP 9.6% MTD and was DOWN 46.3% in 2024.

Like our new site? Here are 10 ways to get involved:

- Listen to the MunAiMarkets theme song and join the rich man’s world!

- Follow MunAiMarkets on Facebook and never miss an article.

- Share this article on LinkedIn, X and/or Pinterest.

- Watch our latest video posts on youtube.

- Comment on the articles and ask any questions you have.

- Submit an article for posting consideration.

- Become the site’s primary contributor and a full partner.

- Advertise on the MunAiMarkets banner for a token $10/mo. in 2025.

- Sponsor one of the site categories or an individual article for a modest fee.

- Support our efforts with a modest financial contribution.