The Problem

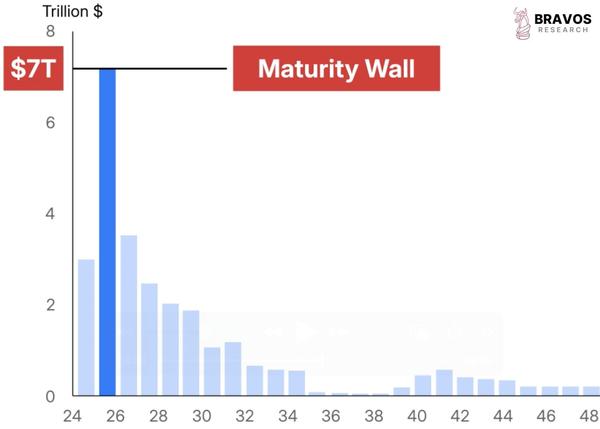

…”This year, $7 trillion in U.S. Treasuries matures…it has to be paid, or more accurately, refinanced so it must issue new debt to repay the old. In other words, roll the debt forward…[and that’s] where things get dangerous” says Bryan Lutz, editor of dollarcollapse.com , in comments that have been edited [ ] and abridged (…) below to provide a faster and easier read.

|

To refinance that much debt, the government must flood the market with new Treasuries [and] that creates a massive surge in bond supply…[which causes] bond prices [to] fall [and] yields to rise…[and] higher yields mean the U.S. government pays more just to finance its existing debt…[but] the big buyers who used to help absorb Treasury issuance—the Fed and foreign governments—have stepped back [and] that leaves the U.S. exposed.

If buyers hesitate or demand even higher yields, it could trigger ripple effects across the financial system:

- Spiking mortgage and credit card rates

- Falling bond and stock prices

- A weakening dollar and

- growing doubts about U.S. solvency…

How To Invest In Such An Environment

…Three strategic moves stand out right now:

- Short-Term T-Bills

- Right now, you can earn 5%+ on 3–6 month Treasury bills, with virtually no risk [and] that’s a safe way to protect capital while staying liquid and nimble—especially if things break, and if the Fed starts cutting rates…[That being said, however, the Fed doesn’t] seem to have plans to cut rates quickly in the next six months.

- Hard Assets: Gold & Silver

- When governments are buried in debt and forced to debase their currency, hard money shines…and when confidence cracks, say in the US dollar, [precious metals] tend to move fast.

- Inverse Bond ETFs

- …Inverse bond ETFs like TBF (1x inverse 20+ year Treasuries) or TMV (3x leveraged inverse) go up when long-term bond prices fall…[but] they’re not for the faint of heart. [They’re] really for the person who has dry powder to spare…They’re for traders who see the writing on the wall because…this $7 trillion wall isn’t a forecast – it’s happening, this year…

Conclusion

The U.S. is rolling over mountainous wall of debt at higher interest rates, which in the end tightens the noose on the system itself…”