Introduction: There is no shortage of expert forecasts and predictions for what will happen to the world’s economy, markets, geopolitics, and technology in 2025 and below VisualCapitalist have summarized the most common predictions and forecasts by experts into a single visual of what they expect to happen in 2025. Geopolitical Predictions for 2025 Economy and Markets […]

Introduction: There is no shortage of expert forecasts and predictions for what will happen to the world’s economy, markets, geopolitics, and technology in 2025 and below VisualCapitalist have summarized the most common predictions and forecasts by experts into a single visual of what they expect to happen in 2025. Geopolitical Predictions for 2025 Economy and Markets […]

Introduction: Lance Roberts points out in his latest newsletter that “over the last two weeks, sentiment reversed from negative to extremely bullish following the inauguration…and the investor “Fear/Greed” gauge moved from neutral territory back into extreme greed. The Market Greed/Fear Index (The Market Greed/Fear Index is based on how professional and retail investors position themselves based on equity […]3. Any Way You Look At It, Lower Returns Are Expected From Equities In 2025

Introduction: Lance Roberts points out in his latest newsletter that “over the last two weeks, sentiment reversed from negative to extremely bullish following the inauguration…and the investor “Fear/Greed” gauge moved from neutral territory back into extreme greed. The Market Greed/Fear Index (The Market Greed/Fear Index is based on how professional and retail investors position themselves based on equity […]3. Any Way You Look At It, Lower Returns Are Expected From Equities In 2025 Introduction: Lance Roberts points out in his latest newsletter that “understanding the trajectory of corporate earnings is crucial for investors, as these earnings significantly influence stock valuations and market performance. Economic indicators such as Gross Domestic Product (GDP), the Institute for Supply Management (ISM) Manufacturing Index, and the Chicago Fed National Activity Index (CFNAI) provide […]4. Investing In 2025: “You don’t have to be a genius—just don’t be a schmuck!”

Introduction: Lance Roberts points out in his latest newsletter that “understanding the trajectory of corporate earnings is crucial for investors, as these earnings significantly influence stock valuations and market performance. Economic indicators such as Gross Domestic Product (GDP), the Institute for Supply Management (ISM) Manufacturing Index, and the Chicago Fed National Activity Index (CFNAI) provide […]4. Investing In 2025: “You don’t have to be a genius—just don’t be a schmuck!” Introduction: Lance Roberts points out in his latest article that, “with slowing economic growth, fiscal policy uncertainties, global challenges, overconfident sentiment, and ambitious earnings expectations, investing in 2025 will require a blend of optimism and caution. have plenty of reasons to approach the markets carefully. Taking advantage of bullish advances while they last is […]5. Rogers & Buffett Have Drastically Reduced Their U.S. Stocks: Here’s Why

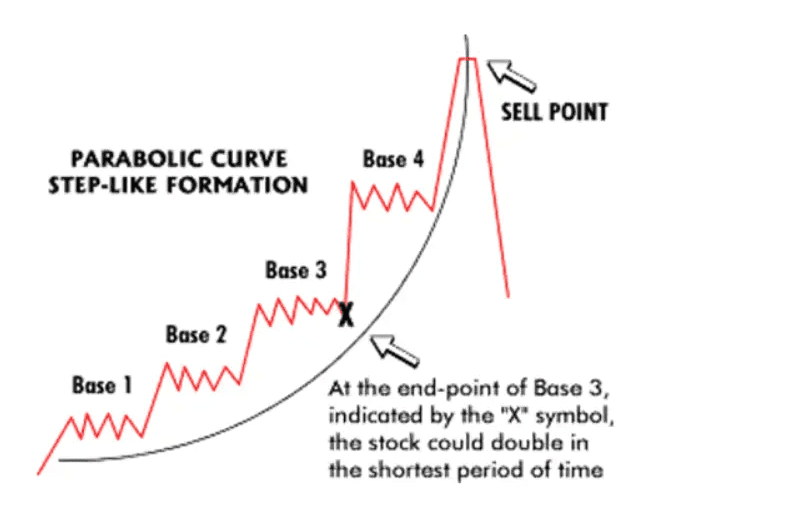

Introduction: Lance Roberts points out in his latest article that, “with slowing economic growth, fiscal policy uncertainties, global challenges, overconfident sentiment, and ambitious earnings expectations, investing in 2025 will require a blend of optimism and caution. have plenty of reasons to approach the markets carefully. Taking advantage of bullish advances while they last is […]5. Rogers & Buffett Have Drastically Reduced Their U.S. Stocks: Here’s Why  Introduction: In Florian Grummes latest article he states that, overall, global financial markets are facing increased risk and susceptibility to profit-taking after the steep and partially bubble-like price increases in U.S. tech stocks in 2024. Hence, significantly increasing volatility is likely to make life much more difficult for investors across all asset classes this […]6. Eric Sprott: “Harsh Correction Coming, Buy Gold & Silver To Protect Your Wealth”

Introduction: In Florian Grummes latest article he states that, overall, global financial markets are facing increased risk and susceptibility to profit-taking after the steep and partially bubble-like price increases in U.S. tech stocks in 2024. Hence, significantly increasing volatility is likely to make life much more difficult for investors across all asset classes this […]6. Eric Sprott: “Harsh Correction Coming, Buy Gold & Silver To Protect Your Wealth”Introduction: The financial markets experienced significant turbulence in 2024, marked by sharp corrections and volatility and in this video Eric Sprott, an investor and precious metals advocate, provides an analysis of market corrections and a thorough wrap-up of the year’s financial events and market behavior and concludes that now is the time to buy gold and […]

7. Take Cover! US Stock Market Setting Up For “A Massive Implosion”

Introduction: For the last 15 years, all you’ve needed to do to achieve double-digit returns on your money was park it in an S&P 500 index fund, reinvest dividends, and forget about it. That happy ride may be over, according to a new note from Goldman Sachs that points out that the S&P is on track […]