Introduction

Lance Roberts points out in his latest newsletter that “over the last two weeks, sentiment reversed from negative to extremely bullish following the inauguration…and the investor “Fear/Greed” gauge moved from neutral territory back into extreme greed.

The Market Greed/Fear Index

(The Market Greed/Fear Index is based on how professional and retail investors position themselves based on equity allocations, including options, bullish and bearish sentiment, and concerns about risk.)…Source

As investors, we must remain vigilant about the risks we take within our portfolios, as we are never fully sure what “time it is” within any given market cycle. As Jason Zweig said in the WSJ last week: “Whenever markets feel euphoric — like, say, right now! — I’m always haunted by a paragraph Goodman wrote in the late 1960s, during a mania that came to be known as ‘the great garbage market.’ Here it is, as published in his 1972 book Supermoney:”

I’m not saying that the bull market is about to end. However, you should always seek to take the other side of the trade from the market’s dominant emotion. As other people verge on ecstatic, you should become more skeptical…

After decades of learning about market booms and busts throughout history, it seems to me that one of the universal laws is that the smarter investors are, the more they believe they’re smart enough to scale back on an overvalued market before it’s too late. They think that by constantly asking ‘What time is it?’ they’re learning whether there’s still time to make money. What they should be reminding themselves, before it really is too late, is that none of the clocks have any hands.“ and this is the conundrum that investors currently face.

Investors Are Overpaying

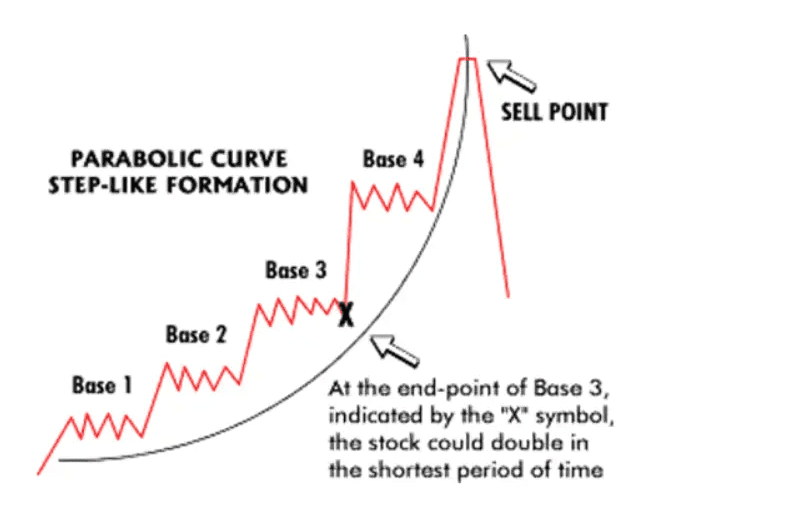

Investors are paying exceedingly high valuations to own assets. The chart below shows the S&P 500’s current deviation from its long-term, exponential growth trend at 147% and that deviation is among the highest levels on record and surpasses that of both the “Dot.com” and “Financial Crisis” peaks. Unsurprisingly, investors’ overpayment of future earnings has also pushed current valuations to some of the highest levels on record.

…At no point in history have consumers been this confident about higher stock prices in the next year. Of course, that optimism is encapsulated by the rise in trailing one-year valuations.

Conclusion

As long as markets rise, valuations are not an issue. However, given that the “clock has no hands,” we never know what market cycle phase we are in. The same was true in 1999 and 2007. Am I suggesting that another “market event” is imminent? No, but given that the clock we are watching tells us little, we must remain invested until chimes start to ring.”